Which of your Debtors is going to default in the turbulent times ahead?

45 years of global experience Future Proofing Small Businesses

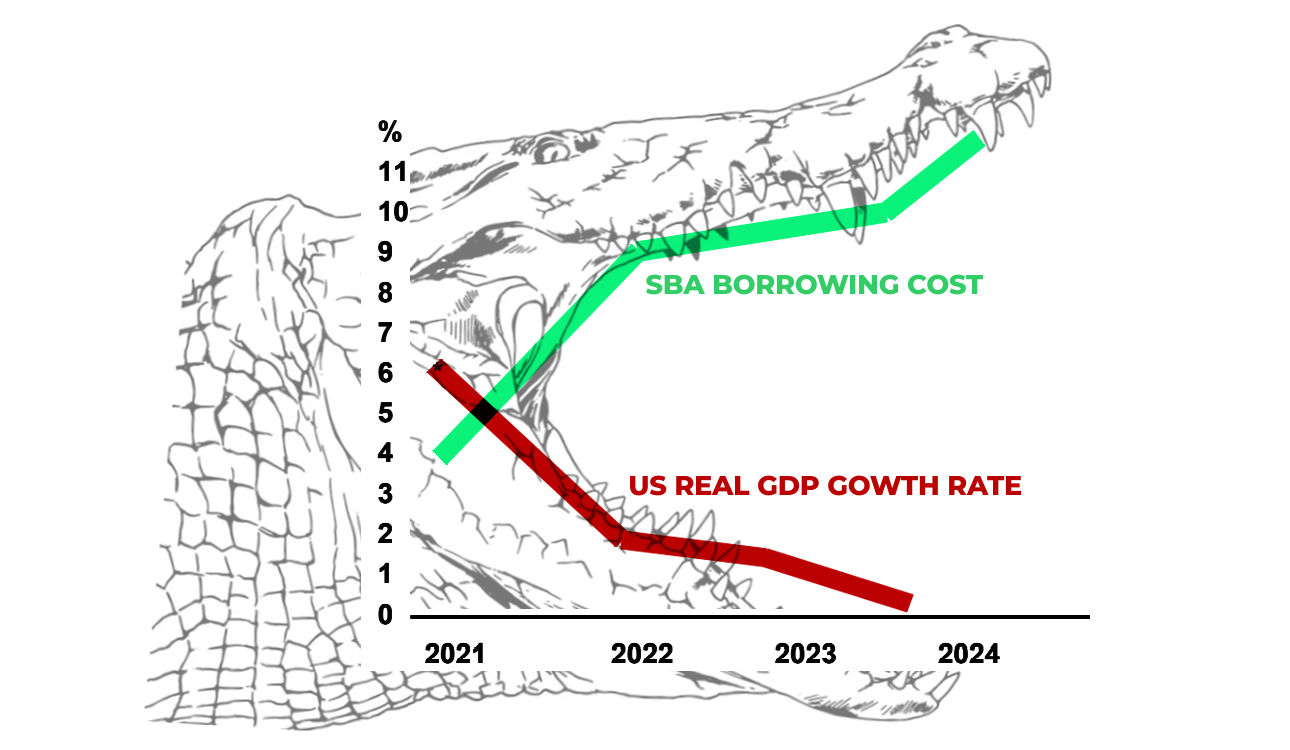

US REAL GDP (Consensus Forecast)

Small Business Administration (SBA) Borrowing Costs: 5.5% p.a. above US Fed Fund Rate

© SmallBusinessProsperity.com 2021

Your Problem

Small Businesses Profit Margins Going Negative?

IN A NUTSHELL

Small Businesses Projected Net Profit/Loss Margins

| US REAL GDP | Fed Fund Rate | SBA* Rate | Net Profit/Loss Margin | |

| 2021 | 5.6% | 0.25% | 4.75% | 10%** |

| 2022 | 1.7% | 4.00% | 9.50% | 3% ? |

| 2023 | 0.5% | 4.75% | 10.25% | -8% ? |

| 2024 | 0.1% | 5.25% | 10.75% | -12% ? |

* Small Business Administration (SBA)

** Source: 10% Net profit margin 2021- Corporate Finance Institute

© SmallBusinessProsperity.com 2021

Your Solution

Facilitating Future Proofing Your Debtor Clients’ Businesses

Business risks are rising fast for your Debtor Clients

“The flapping of a butterfly’s wings can be felt on the other side of the world”- Chinese Proverb underpinning Chaos Theory.

Russia’s invasion of Ukraine in early 2022 could be the spark to ignite new regional and, possibly, global armed conflicts.

Countries with the strongest economies in the world are ramping up their military spending.

Many countries with smaller economies are following suit.

Stumbling economies worldwide, increasing geopolitical war drums, and applied sanctions will damage global trade, consumer, and investment spending.

Most businesses worldwide, including in your country, will be negatively affected in some way, raising their risk profile.

The Hero Creditor

To survive and prosper in this increasingly uncertain future, Creditors and Debtors must have a trustworthy, symbiotic working relationship for mutual benefit.

– As a Creditor, you must facilitate Future Proofing Strategies for your existing and new Debtor Clients to keep paying their debt obligations timeously.

– Working with Future Proofing Experts having 45 years of local and global experience will keep your Debtor Clients surviving, prospering and paying their debt obligations timeously during the much harsher economic and escalating geopolitical flash points ahead.

– Imagine the reputation you will achieve by facilitating your Debtor Clients to become Future Proofed. Other potential Debtor Clients will also want to be future-proofed, increasing your market share.

How we do this:

Stage 1 – Initial Future Proofing Assessment Report.

This Initial Assessment is an unbiased, independent, holistic, 360- degree investigation and assessment of your current, or potential, Debtor Client’s business.

Critical Thinking and Problem-Solving Techniques are used.

The Future Proofing process is achieved via a written and verified Initial Q&A process with your Debtor Clients. This process uses critical thinking and problem-solving techniques.

The World Economic Forum’s (WEF) Future of Work Report 2020 stated, “critical thinking and problem-solving top the list of skills employers believe will grow in prominence in the next five years.”

The Report also stated, “50% of all employees will need to be reskilled by 2025 as adoption of technology increases.”

The Process

20 Major Elements and 80 sub- Elements of your Debtor Client’s business are investigated and assessed independently and unbiasedly via a verifiable Q&A process with your Debtor Client.

1. Understanding your business– past, present, future.

2. Positive and negative global, national, regional, and local trends affecting and impacting your business’s performance levels.

3. The physical location/s of your business

4. Digital participation in your business.

5. Your abilities to manage your business.

16. Financial returns. (Verification from their Auditor is required.)

17. Financial controls analysis.

18. Suitability of Businesses premises.

19. Strengths, Weakness, Opportunities, and Threats affecting your business (SWOT analysis) (These are derived from the above analysis and relevant input from the Debtor Client)

20. Potential for either growth or decay of the business.

The results are stated in a report.

The Initial Future Proofing Assessment Report of your Debtor Client.

We will provide Guidance to You and Your Debtor Client.

Capable of being Future-Proofed

If your Debtor Client is capable of being Future Proofed, then this Initial Future Proofing Assessment Report is presented to you and your Debtor Client.

As stated above, your Debtor Client will benefit substantially from this researched information about their business, especially if there are elements highlighted for positive and/or remedial action.

Not capable of being Future Proofed

Suppose your Debtor Client appears not to be capable of being Future Proofed at the time of the Initial Future Proofing Assessment Report. In that case, the concerning issues will be highlighted in the Report for remedial action by the Debtor Client.

Should these issues be successfully addressed, then a reassessment of the Debtor Client’s business will only cost 50% of the standard charge of $490.

Financial Peace of Mind for you and your Debtor Client.

Both you and your Debtor Client will benefit substantially from the Initial Future Proofing Assessment Report.

By Future Proofing your Debtor Client’s net income and prosperity will ensure their debt obligation payments are made timeously in the bleaker economic and sabre-rattling geopolitical times ahead.

That is priceless.

Cost of the Report

Subject to the written consent to participate and the subsequent cooperation of the existing or new Debtor Client in the verified Q&A Process, the Report will be completed by us in 7 working days after all the verified information is received.

The cost is $490, payable by you and/or the Debtor Client and is only payable once we receive the Debtor Client’s written commitment to proceed.

What we do next:

Stage 2

Prosperity Action Plan for your Debtor Client’s business.

¹ An option exists for you and/or your Debtor Client to continue the Future Proofing investigation and assessment process for us to create a Prosperity Action Plan for your Debtor Client’s business.

³ The Prosperity Action Plan will, arguably, be the most enlightening, informative, and proactive Report read by your Debtor Clients since starting their businesses.

The benefits of prosperity will be substantial, especially during the 2023-2025 tough economy, potentially worsening with the increasing war drums among economically powerful nations.

Unless your Debtor Client is in the armaments or allied, supportive industries, the growing sabre rattling from various regional and global powers and possible imposing

of economic sanctions is very worrying for future international trade, consumer, business, and investor confidence.

Global trade and investment could take a ‘blow to the head.’ This could further negatively impact global economic growth, feeding down to your Debtor Clients’ businesses, wherever they are in the world.

Even without the threat of further regional and possibly global war-mongering, the World Bank expects the annual global economic growth rate in 2022-2029 to be 2.2% p.a., 33% lower than the 2010 decade’s average annual growth rate of 3.4%. This lower global economic growth rate will pressurize your Debtor Clients’ businesses, and a Prosperity Action Plan becomes a ‘must have’.

⁴ If this Prosperity Action Plan advice is implemented, you and your Debtor Clients will know substantial peace of mind during these forthcoming economic and geopolitically turbulent years.

Prosperity Action Plan Process

The Prosperity Action Plan Process comprises:

1. Proactive Business Strategy

2. Strategic Consultancy Service with ongoing consultancy, if required

3. Creative Action Plan – Case Studies

More details of the three processes will be disclosed and discussed appropriately.

Initial discussion before committing to the Prosperity Action Plan

Before beginning this Prosperity Action Plan, a dialogue will need to occur between you, your Debtor Client and us to ensure that all parties want to proceed and are committed to the process.

Cost

The in-depth process of creating a Prosperity Action Plan takes 1- 3 months from all the verified Q&A submitted to us.

The Prosperity Action Plan costs $2600 for a Small Business Debtor Client, payable by you and/or your Debtor Client.

Furthermore, if required, we will explain the benefits of the optional Stage 2 process to your Debtor Client.

Let’s get moving – Stage 1

Initial Future Proofing Assessment Report – $490

Sample limited Free Trial Offer

We offer you a sample limited Free Trial. We will provide you with 20 of the 80 questions in the Initial Future Proofing Assessment Report. It’s an example of the questions your Debtor Client requires to provide verifiable answers. Those 20 questions should be shared with your Debtor Client. They should also visit this website to get a clearer picture of how we can help them by Future Proofing their business during the unpredictable nervous times ahead.

We can provide your Debtor Client with the backup motivational information they should see to understand the verifiable Q&A process and the benefits received from the Initial Future Proofing Assessment Report.

Furthermore, if required, we will also explain the benefits of the optional next stage, the Prosperity Action Plan.

An Initial Future Proofing Assessment Report of your Debtor Client.

Once we begin communicating with you, we will discuss the commitment requirements of your Debtor Client to the verifiable Q&A process to create their Initial Future Proofing Assessment Report.

This Initial Future Proofing Assessment Report costs $490 and can be payable by you or your Debtor Client.

Payment will only be made after obtaining your Debtor Client’s written commitment to proceed.

We look forward to future-proofing your Debtor Clients’ businesses, timeously keeping their debt obligation payments to you during stormy times ahead.

Due to the specialized skills required, which have been built up over 45 years, locally and globally, we only work with a few clients at any time.

Complete the form below, and let’s get the ball rolling.

Contact Form